37+ Fha Chapter 7 Bankruptcy Waiting Period

The waiting period to get an FHA loan after a bankruptcy without extenuating circumstances is. Exceptions for Extenuating Circumstances A two-year waiting.

Lowers Mandatory Waiting Period After Bankruptcy Short Sale Pre Foreclosure National Brokers

We fight banks creditors and harassing debt collectors so you dont have to.

. A down payment of your own. Exceptions for Extenuating Circumstances A two-year waiting. To get an an FHA loan after a bankruptcy you should plan on saving up for.

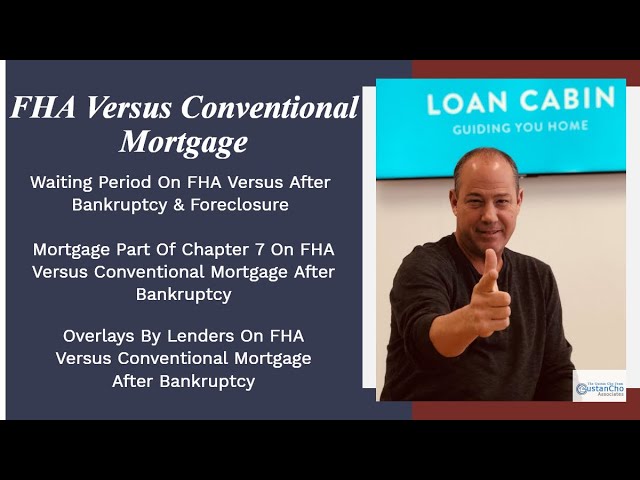

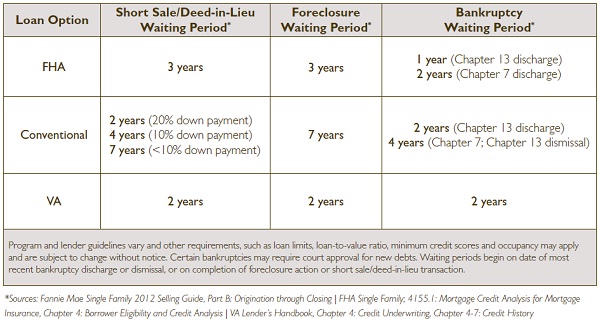

Fha Loans After Chapter 7 Bankruptcy If youve filed a Chapter 7 Bankruptcy FHA says you can purchase a home after a two-year waiting period. A four-year waiting period is required measured from the discharge or dismissal date of the bankruptcy action. Chapter 7 Two years from the time of discharge.

A four-year waiting period is required measured from the discharge or dismissal date of the bankruptcy action. Chapter 13 Two. If a mortgage loan debt was discharged through a Chapter 7 bankruptcy the mandatory waiting period after a bankruptcy discharge date is the waiting period start date.

But without extenuating circumstances their standard waiting period is four years one longer than FHA. The 4 year waiting period start clock starts from the recorded date of the deed in lieu andor short sale date. The benefit of FHA loans over many other loan programs is that.

A Chapter 7 bankruptcy does not absolve you of alimony unpaid taxes or child support. The waiting period is extended to 7 years after standard. Dec 24 2022 - Want to file Chapter 7 bankruptcy in.

Federal bankruptcy courts manage cases according to the US. Chapter 7 chapter 11 and chapter 13. Upsolve is a legal aid nonprofit that provides free Chapter 7 bankruptcy attorneys to debtors in Anacortes WA that want to erase debt.

Carroll has represented individuals married couples and small business owners in thousands of bankruptcy cases over more than 20 years. I will make sure that you remain fully informed. Bankruptcy law includes several types of bankruptcy.

Ad Local and family-run Bellingham bankruptcy law firm with 35 years of experience. Mortgage after bankruptcy. The minimum waiting periods to get a mortgage after Chapter 7 are as follows.

Chapter 7 filers can expect their bankruptcy to show on their credit record for a ten-year. We offer experienced competent and. Chapter 7 waiting periods.

Two years USDA loans. Two years VA loans. Kamb Law Office provides the Mount Vernon Washington area with dedicated representation for Chapter 7 and Chapter 13 bankruptcy cases.

Three years Conventional loans.

Getting An Fha Loan After Bankruptcy Or Foreclosure

Fha Loan Rules For Borrowers After Filing Bankruptcy

Fha Bankruptcy Guidelines 2019 Waiting Period After Chapter 7 And 13

First Mortgage Corporation Ppt Download

Fha Versus Conventional Mortgage After Bankruptcy

How To Get An Fha Loan After Bankruptcy Bayou Mortgage

Major Credit Event Buying A House After Bankruptcy Or Foreclosurerichmond American Homes

2022 When Can I Qualify For A Mortgage After Bankruptcy Short Sale Foreclosure Or Dil Find My Way Home

What Are The Pros And Cons Of Filing Chapter 7 Bankruptcy

Lake Charles Area Home Finder S Guide November 2022 Volume 37 Issue 5 By Digital Publisher Issuu

11 Steps To File Bankruptcy File Today Get A Fresh Start

Thousand Oaks Bankruptcy Attorney Chapter 7 Chapter 13 Bankruptcy Attorney Nathan A Berneman Apc

Fha Waiting Period After Bankruptcy And Foreclosure

Mortgage Approval After Foreclosure Bankruptcy Or A Short Sale American Liberty Mortgage Inc Orlando Florida

What Is The Fha Bankruptcy Waiting Period O Bryan Law Offices

Getting An Fha Loan After Bankruptcy Or Foreclosure

Fha Loan After Chapter 7 Bankruptcy Mortgage Guidelines